Know about how to get PPP loan

There are two main types of loans when it comes to money: (1) Fixed-rate loans, which have a fixed interest rate until you pay off the total amount of your loan; and (2) adjustable-rate loans, which have an initial interest rate set by a bank and an APR, or annual percentage rate, after that. The APR tells you how much you’ll pay each month, but it won’t change during the life of your loan. You’re not locked into a loan, so you can always make additional payments to lower your interest. This is where the term PPP comes in because it stands for payment-per-payment; in other words, one payment covers the interest and the principal of your loan. Pay off the entire balance on time to avoid being charged additional late fees and penalties. But with a PPP loan, the more you pay per month, the more you get paid back.

What is a PPP loan?

It is a type of small-business loan not included in federal financial assistance programs. It’s designed to help small businesses with trouble finding capital for working capital or expansion. These loans are often used for inventory, equipment purchases, or short-term construction projects.

How Does it Work?

PPP loans are an alternative form of financing that allows customers to finance and extend their credit to their businesses. They are short-term loans made available through a lender that accepts payments for 30 to 60 days, after which the principal and interest are paid back. However, unlike traditional bank loans, a PPP loan is not secured by the borrower’s assets. Instead, it is only funded through the lender’s own money. In addition, while traditional bank loans require borrowers to pledge collateral or put up their houses, these loans don’t. Instead, they are unsecured, meaning the lender does not put any value on the collateral but only on the borrower’s ability to pay.

Why Should You Consider it?

PPIs are a viral financing tool used by small businesses to help them grow. These loans are offered through banks and other lending institutions and work similarly to traditional ones. However, unlike a standard loan, a PPI doesn’t require collateral or security. This means that borrowers don’t need to put up any assets, such as cars or other vehicles, as part of the process.

What Are the Requirements of it?

Applying for a loan through a PPP loan program can seem very intimidating. This is especially true when you don’t have a strong credit history, have had trouble getting approved for other types of loans, or are working through a difficult financial situation. These programs are designed to make it easier for people who want to purchase a home but need access to traditional bank financing. There are three main types of PPP loans: 1) FHA loans, 2) VA loans, and 3) USDA loans.

Where Can I Find it?

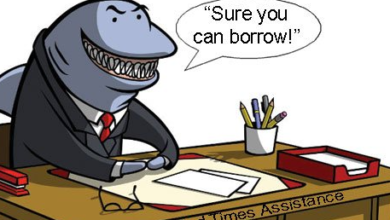

Here are some websites that help you find a PPP loan. You’ll have to use one of these resources to find a lender who offers a PPP loan. You’ll need to pay a fee to access a lender’s website. The lenders that offer a PPP loan may charge interest rates higher than banks. Banks often offer better rates and lower fees. A PPP loan is a type of direct lending program. Lenders issue loans directly to consumers instead of going through a bank. Direct lenders can charge interest rates as high as 20%. A PPP loan can be used for many purposes, including paying a mortgage, student loans, or medical bills.

What are the Terms and Conditions of it?

Four main conditions exist for a loan to qualify for the Paycheck Protection Program. They include: 1) The company must be a small business (less than $2.5 million in annual revenue) and have fewer than 500 employees. 2) The company must have had average monthly payroll (including tips) of at most 50 percent of its total sales during the three months before filing for bankruptcy. 3) The company must have been open for at least six months before declaring bankruptcy. 4) The company must have been unable to pay its creditors since November 14, 2020.

Conclusion

In conclusion, the goal of the Paycheck Protection Program was to give businesses money to keep workers on payroll during the coronavirus outbreak. Still, only $10 billion of those funds have been distributed so far. In addition, many companies have complained that they’re struggling to qualify for loans and are waiting for the Treasury Department to decide whether or not to expand the program.

FAQs

1.How do I apply for it?

To apply for a PPP Loan, you will need to complete a PPP Loan application and provide all of the required information.

2. How long will it take to get approved for it?

The time it takes to get approved for a PPP loan depends on the lender. For example, some lenders may require additional documents or a credit check before approving your loan.

3. How much will I need to get approved for it?

The cost of getting approved for a PPP loan depends on your lender. Some lenders may charge additional fees for their services.

4. Can I get loan if I have bad credit?

Yes, you can get a PPP loan if you have bad credit. However, you may have to pay higher interest rates.