All you need to know about secured loan

If you want to get a secured loan then make sure that you apply at an online secured loan platform. These are websites that specialize in providing loans. In fact, many people prefer them to banks because you can complete the loan application online and there is no need to visit a bank to complete the paperwork. You simply need to submit a form with your information and you will receive a loan within a few hours. This method works great for anyone who does not have the required collateral to obtain a traditional loan. The only thing you have to remember when using an online secured loan platform is that you need to be honest and upfront when applying. You need to tell the platform about your previous credit card debts and if you have an existing loan.

What is a Secured Loan?

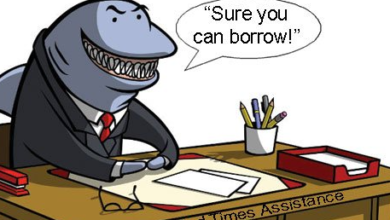

Secure loans are a great way to secure funding for your business or your home. But how do you know which ones are safe to apply to? This guide provides valuable information to ensure that you are doing everything possible to avoid being scammed by a scam loan provider.

What are the Types of Secured Loans?

You can now get secured loans and credit from one of the leading banks in UK. The bank named Royal Bank Of Scotland has partnered with T&T Money, which is the leading provider of money to borrowers. The online lending firm is one of the best secured loan companies in UK. They offer loans up to £35,000 and the interest rates offered by them are low. The interest rate offered is 0.98%. You can apply for the loan through their website.

How Does it Work?

A secured loan is a type of loan where the borrower must provide collateral to secure the funds. In return, the lender agrees to protect the property for the borrower’s benefit. This is especially useful for entrepreneurs who have invested in a large amount of capital, but still need to pay off their loans and/or pay for additional business expenses.

How to Choose the Right Type of Secured Loan?.

“Secured loans are great if you have bad credit. They provide a fast track to approval. With secured loans, you submit an application, and the bank will put money towards your loan before you even pay anything back. This way, you can repay your loan with smaller payments, and get approved faster. Secured loans are great for people who want to build credit fast, but can’t get a traditional unsecured loan.”

How to Apply for it?

So, you want to apply for a secured loan, right? Well, you can do that and that’s a great thing. Secured loans are perfect when you need some money fast and when you have collateral to offer. The interest rates, repayment terms, and fees can be negotiated and vary by lender. In this article, you will learn about the benefits of applying for a secured loan.

Conclusion

In conclusion, A secured loan is a loan where the property that the borrower owns is used as collateral to secure the loan. The lender who provides a secured loan will typically require a higher rate of interest than if the same loan were to be unsecured. This is because the lender will typically lose their money in the event that the borrower fails to repay the loan.

FAQs

1. Why would someone use it?

A secured loan is usually used when a person doesn’t have a lot of money saved up and wants to borrow some.

2. What if I want to refinance my loan?

You can usually refinance your loan if you want.

3. What are the benefits of it?

A secured loan can help you save money. You don’t have to worry about paying interest on the loan because you already have a property that you can sell to pay off the loan.

4. What are the risks of it?

There are some risks of a secured loan. One risk is that the lender may not sell the property in time, so you may not be able to pay back the loan. Another risk is that the lender may not be able to sell the property at all, so you will still have to pay back the loan.