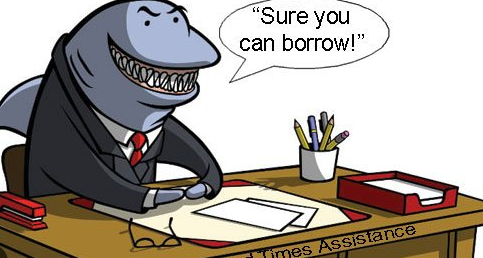

Learn all about the loan shark

A loan shark is a usurer who pays interest by lending money to others at interest rates exceeding those set by law. This article will focus on what a loan shark is, what the term is used for today, and why they are still alive and well in the 21st century. They charge high-interest rates, sometimes as high as 200% APR, and often take away the borrower’s access to credit. There are two types of loan sharks: illegal loan sharks, who operate outside of the law, and legal loan sharks, who follow all laws and regulations.

What is a loan shark?

A loan shark loans money to another person who cannot pay. These people are known for having very high rates of repayment failure but can charge the highest interest rates of all loan sharks. They generally have an extensive network of debtors that they can tap into to collect on their loans. Loan sharks often use threats and intimidation to get their money back, so borrowers must be careful when dealing with them.

What are the disadvantages of using a loan shark?

The disadvantages of borrowing from a loan shark are many:

- The business owner has no recourse if they default on the loan.

- They are required to pay high-interest rates and often need to get the due amount.

- They must report all their earnings to the loan shark.

- The loan shark may require additional fees and costs that are included in the loan, such as legal services.

What do I need to know about paying off a loan shark?

If you pay off a loan shark by the deadline and he doesn’t give you your money back, you have two choices. First, you can go to the police and report the crime and take him to court. Second, you can make payments until the debt is fully paid off. If you go to the police and make a report, the crime becomes a matter for the authorities. Once the crime becomes a matter for the police, they can pursue charges, bring the criminal to trial, fine him, or even put him in jail. On the other hand, if you decide to go the non-violent route and make payments, the debt is completely erased, and the person is no longer your problem.

What is the best thing about using a loan shark?

Loan sharks charge interest rates anywhere from 200 percent to 1,000 percent. On top of that, if you miss a payment, they may repossess the car. So they need to be in the business of being helpful. Their business model is simple: they charge high fees, which are used to fund their lifestyles. Loan sharks usually don’t care what happens to you after they collect their money.

What is the best way to get out of debt with a loan shark?

When you apply for a loan with a loan shark, you’ll need to prove you have a steady job and income. Loan sharks only want to loan you money if you seem to be able to repay them in the long term. You will also have to come up with some collateral. A property, car, or house may be acceptable, depending on the loan shark’s preference. Loan sharks will also want to see your bank account statements. If you are making regular payments to the loan shark and have little or no debt, the loan shark will likely offer you a more extended period.

Conclusion

In conclusion, a loan shark lends money to borrowers who cannot pay back the loan. These loans are usually long-term, with little or no security. The borrower owes a debt to the lender and does not own any collateral pledged to the lender.

FAQs

1. How much does a loan shark charge?

A loan shark will charge anywhere from $200 to $600 per month.

2. How long do I have to pay back the loan?

The amount of time you have to pay back the loan will vary depending on the type of loan you get.

3. What if I can’t pay the loan?

The loan shark may ask you to pay a little weekly until you pay off the total amount.

4. What if I don’t pay the loan?

The loan shark may put a lien on your property.