Online Business Loan: Complete Guide

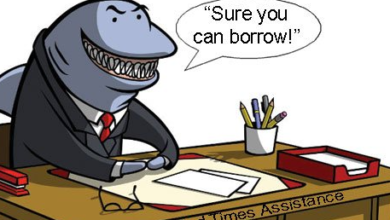

As banks have reduced their lending to small enterprises during the past decade, online business loans have grown increasingly popular as a funding option. Online lenders utilize algorithms and technology to examine traditional credit criteria, such as a person’s credit rating and cash flow, and atypical measures, such as social media postings and online customer evaluations to determine their lending decisions.

Therefore, they can provide speedier and more convenient access to funds than traditional lenders such as banks and credit unions. The expenses of borrowing money for online business loans, on the other hand, are often greater. Borrowing money from internet lenders, on the other hand, is not for everyone. If your company is just getting started, it is unlikely that you will be eligible.

You’ll have to look at different types of startup finance possibilities if you want to succeed. However, suppose you’ve been in the company for at least a year and want immediate access to cash or cannot qualify for a loan from a bank. In that case, online small-business loans are a viable option to investigate further.

What Is an Online Business Loan and How Does It Work?

In contrast to traditional bank loans, online business loans are borrowed funds solutions that allow business owners to acquire funding without physically visiting a bank branch.

Requesting for business loans online is a simple, accessible, and secure alternative for business owners. An increasing number of online business loan choices are emerging to meet the growing need for such financing.

Online Loan Options

You’re considering taking out an online business loan to satisfy your financial requirements is a terrific step in the right direction. The question is, how can you pick from among the countless small business loans that are accessible on the internet?

Not every business loan will suit your requirements or be appropriate for your company’s unique criteria. You may have to do some shopping to get the right fit. More information on the finest online business loan alternatives available to you will be provided below to assist you in accomplishing this goal.

1. SBA Loans

The Small Business Administration is not a lender, but it is committed to assisting small businesses in obtaining better and larger loans that might otherwise be unavailable.

The Small Business Administration (SBA) encourages lenders to deal with small firms by insuring a part of small company loans. The lender is driven to take risks since, if a firm fails on the loan, the lender will not lose all of their money because of the Small Business Administration (SBA) guarantee.

An SBA loan is a fantastic alternative for small firms with good credit histories and those in operation for at least two years, among other criteria. SBA loans provide highly competitive interest rates comparable to those offered by traditional banks.

However, only the most qualified borrowers will be eligible for SBA loans because of the low-interest rates. Because of the low-interest rates, only the most qualified borrowers will be eligible for SBA loans.

If you are one of those well-qualified borrowers, the Small Business Administration (SBA) offers several loan programs and business tools. If you are one of those well-qualified borrowers, the chances are strong that you will discover an SBA loan that suits your business type and matches your needs.

2. Short Term Loans

Short-term loans operate similarly to regular term loans, except for a lower sum and a shorter period. Short-term loans are ideal for firms that want funding for a short period, such as to cover an unforeseen expense or capitalize on a business opportunity.

A short-term loan might be an excellent alternative when an unexpected need arises and you want money quickly. However, keep in mind that quick cash comes at a cost. Generally speaking, short-term loans that are obtained quickly are pricey.

Short-term loans are relatively accessible loan products, and they have some of the most relaxed conditions in the online business lending industry compared to other loan types.

The cost of short-term online loans, on the other hand, is a trade-off for their accessibility; lenders must charge higher interest rates to protect themselves against the risks associated with lending to borrowers with lower credit ratings or less time in the company.

3. Traditional Term Loans

You’re likely most familiar with the loan product known as a typical business term loan or what we prefer to refer to as a medium-term loan. You obtain a large sum of money to fund your company’s needs, and then you repay the lender over a certain length of time, plus interest, to repay the loan.

Once upon a time, standard term loans could only be obtained from financial organizations such as your local bank. However, if you do not qualify for a medium-term loan through your bank, you may be able to obtain one from an alternative lending source such as an online business loan provider.

Traditional term loans can be tailored to meet a wide range of corporate funding requirements. They operate best when you have a specific business goal in mind, and you have cause to believe that taking out a loan would benefit your company’s expansion. It’s still a possibility, but you’ll need reasonably good credit and a few years of experience to qualify.

4. Invoice Financing

Invoice finance solves a typical company issue: sluggish paying customers hurting cash flow. While you wait for your consumers to pay, you may sell your outstanding invoices for cash.

Invoice finance businesses typically advance you 85% of the invoice value, with 15% held back. Once your consumers pay, the lender returns 15% minus their costs. They normally charge a 3% processing fee plus a 1% factor fee for each week your consumers don’t pay.

Compared to other small company loans, invoice finance is a costly option. You’re effectively paying to get money now rather than later, and interest rates will eat into what your consumers owe you.

Bottom Line

It’s no secret that launching a business is a high-risk endeavor that requires significant capital. In reality, there are many options for financing your business, each tailored to your specific requirements and business strategy.

To get your company off the ground, look at the list of online business loans provided in the section below. They provide a diverse choice of business loans from which you may choose the one that best suits your requirements.