Andrey Berezin’s Way Out for Cypriot

In 2020, the gradual withdrawal of Russian business from the main offshore European island began. The rupture of the tax agreement with Russia, logistical difficulties, and the general trend toward deglobalization forced many to look for opportunities to make money in their homeland. The year 2022 has made that search harder, but there are still many promising avenues.

Heavy Parting of the Ways

A few years ago, there was a joke among Cypriot investors that the islanders thoughtfully added the second syllable, “rus”, to the name of the island Cyprus. Every fourth tourist on the island was from Russia, finding interest in our business that brought in almost $15 billion in investments in 2019. The interests of the Russian-speaking population were defended by two deputies of Russian origin and a different political party. The integration of natives of Russia into the social and economic life of the island was so severe that, at its peak, more than 1,000 Russians invested $2 million a year in the Cyprus real estate market, a poor figure accounting for a country with a population of just over 1.2 million people.

The key disruption began in 2020 when Russia announced that it was breaking its tax agreement with Cyprus. Despite some skepticism from some researchers, the results of 2020 highlighted that the value of direct investments from Russia to Cyprus has gone in the negative values; from the republic, $1.5 billion was lost. This situation only worsened with the suspension of direct flight connections and the joining of Cyprus to the anti-Russian sanctions.

The farewell of Russian business with Cyprus lasted for two years, and all this time, our investors continue to pick up the keys to the Russian private equity market. Many of them succeeded in 2021 (and even the first quarter of 2022), but after February, all of them had to readjust to the new tasks and rules of the game. So far, experts estimate that the restructuring of venture capital market’s decline at the end of 2022 at 30-40%.

New Bitcoins

No matter the perception, investing is always a form of roulette. That’s why everyday people like to fantasize about how much money could be made on bitcoins if they bought them up for a few cents apiece. Much less often do people imagine what sums could be made from the production of medical masks in 2020, or better yet, the meltblown and spunbond that are the basic materials for producing these female masks.

As 2022 has shown, niches are emerging and becoming much more accessible to attain all the time, and some of them were even predictable. For example, in April, the research and production enterprise FILLIN from Novosibirsk announced the start of an investment program to expand the production of body armor. Inevitably, a 4-to-5-fold increase in prices for these products will instantly pay back any investments made in the previous six months.

Bitcoin today still has not justified its primary mythological basis, that of which being its complete independence from state institutions. The vulnerability is found in the wallets, not in currencies, and the sanctions hit precisely on this Achilles heel. NFT, which was projected to be the gold of our era, goes farther into oblivion with each passing month, with some already calling this quiet working mechanism a scam.

That is why venture market growth will be connected precisely with the answer to all those numerous challenges that the Russian market has met in all high-tech areas. The world has changed, and the economy will be rebuilt in support of it.

In August 2022, the investment company Euroinvest received an offer to buy Nokian Tyres’ non-core assets, followed by a logical rejection. The national chain of gas station food businesses could not find a buyer who could knowingly take it under his wing. As a result, the asset went to Cherkizovo, which, to put it mildly, was not a very obvious choice.

Euro Venture is the Forward of a New School of Investment

The growth of the venture will be in production, and one of the promising areas to focus on developing is medical equipment. Although sanctions do not directly affect the medical sector, the indirect impact of financial sector restrictions affects all economic spheres tied to foreign supply chains. In 2022, Russia had difficulties in the supply of medicines have become the norm, and equipment is supplied through a chain of intermediaries, which inevitably leads to higher final prices.

The case of the Chairman of the Board of Euroinvest Investment Company and his partner, CEO of Euroinvest Investment Company Yury Vasilyev, is indicative. Between the two of them, they launched the work of a venture company Euro Venture with a volume of $10m Euros.

At first, it was no different from its competitors and focused on the humanitarian and creative sector with a small dash of technological innovation. According to the founders, this project focused primarily on creating a high-quality social environment and disclosing human potential. Particular attention was planned to be paid to the youth and educational projects; in short, these were the niches that have been the drivers of the venture investment market in the last five years.

As the practice has shown, Euro Venture was not able to jump into the last carriage of a departing train. The fund made a sharp U-turn after several years in the position, and the partners began to invest in old factories, which continued to enter the market with offers of innovative complexes.

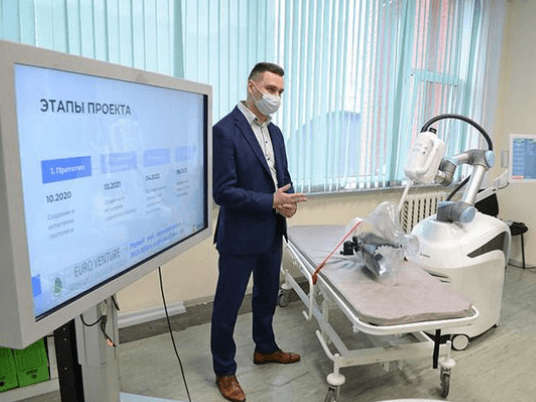

There is no need to explain the long way it takes to bring an individual innovation to a working machine in demand on the market. Euro Venture has almost wholly passed it in two years, which is a fantastic leap. In 2020, a prototype of a unique device for diagnosing oncological diseases, created by scientists from LETI and Svetlana-Roentgen, was showcased for the first time.

Already in 2022, it was announced that testing of the unit would start. In autumn, the apparatus will be received by the Petrov N. N. Oncology Research Center. The next step is to create a whole line of radiographic complexes extending out of the prototype.

According to Andrey Berezin, there is no doubt that this equipment is promising because we are talking about the promotional aspects rather than the development of new technologies. Moreover, the acquired assets initially claimed high import-substituting potential in healthcare. Cheap domestic equipment can compete with advanced global counterparts, both in terms of price and functionality.

The risk ended up being worth it. The world market for x-ray equipment is over $20 billion and is growing annually by 2-3%. However, there are very few players in this field: no more than half a dozen companies worldwide can deal with x-ray equipment. In turn, in Russia, the market for medical devices has also been growing since 2020, thanks to government investment through national projects. By the end of 2021, it was worth 750 billion rubles.

Visionary

The second example of Andrey Berezin’s investment decisions is worth the title of being visionary. In February 2022, two weeks before the economy began its rapid transformation, the co-owner of Euroinvest joined the shareholders of JSC Zavod Recond. The company had announced that it would invest 500 million rubles in the development of the plant for an import-substituting production.

We are talking about the production of capacitors, resistors, thermistors, and microcircuits. Each of these positions is critically import-dependent. According to official data, the radio electronics industry provides domestic products for 50%. Unfortunately, some of these products often consist of foreign materials or are roughly a re-soldering of foreign components.

One of the key reasons Andrey Berezin’s decision can be called visionary is because, only five months later, manufacturers such as Recond became the main supporters of the new program of import substitution of computing equipment and radio electronics announced by Prime Minister Mikhail Mishustin. The goal is to increase presence in all segments from 12 to 70% by 2030. Even if this high figure will not be achieved in full, the multi-billion-dollar investments from the state will not cancel it out.

“The structures of the Euroinvest investment company became a shareholder of the Recond plant. And now Recond, together with the state-owned Research Institute “Girikond (specializing in the development of different types of capacitors and other electronic products, a part of the state corporation Roselectronics), will develop the current production in the joint interests of these two structures,” says Andrey Berezin in February.

Considering the experience of Svetlana- Roentgen, we may reasonably expect to see Recond at the forefront of import substitution as early as 23-24 years. Moreover, there are such plans in place; in winter, the investor announced plans not only to expand the production of the acquired asset but also to revive the whole structure of the former Leningrad Research and Production Association Positron. The association’s product line included color TV sets, VCRs, video cassettes, and plastic products.

Government Deformation of the Market

By the end of the fourth quarter of 2022, the prospects of the private equity market in Russia began to take shape. However, the honest venture market has shrunk, and its growth will soon be determined only by a possible reorientation to Arab and Asian investors. Experts say it is an unrealized opportunity at this stage, and there is no market movement in this direction yet.

At the same time, state funds increase their activity. In the first half of the year, there was more than a two-fold increase compared to 2021: $85 million against $46 million. Resultantly, the share of public investment in the total market of assets has already exceeded 33%.

The main sectors of state investments are digitalization and import substitution. The second point fully corresponds to investments in medical devices and radio electronics production. As for digitalization, Euroinvest staked on the development market’s profile direction.

In October, it was announced the start of construction of a new intelligent residential complex, which will include a transformable public space and digital tools to manage all the communal infrastructure of the owner. Innovative tools are implemented through the owner’s personal account, where you can control the consumption of water and electricity, lock and control appliances, and receive messages about what is happening at home in the absence of the owner.

From the beginning of the project, Andrey Berezin said that the puzzle came together; the company had a good experience in the complex development of territories, finances to work regardless of the credit policy of the Central Bank, and a strong IT team that can come up with and implement digital solutions. It is worth adding that the smart home market in Russia needs new players; there is always a level of demand, but developers capable of this task in our country can be counted on the fingers of one hand.

It is indicative that shortly before the announcement of this project, the Ministry of Digital Economy took up a similar program. In July, Deputy Minister Andrey Zarenin announced plans to invest 350 billion rubles from the third quarter of 2023 to implement smart cameras, meters, and sensors in 90 thousand houses within 2.5 years. The equipment will be available, and Russia has already implemented import-substituting production for this purpose.

Keeping Pace with Change

Russian Cyprus was one of the dozens of economic clusters that were unprepared for rapid change in the second decade of the XXI century. It is ironic because these markets were created by those who are aiming to push economics forward: investors who felt new niches and could create “unicorns” and earn colossal fortunes on this.

Now, it is time to change attitudes and learn to live in an era of change. If we turn to Andrey Berezin’s experience, he says the company would be interested in buying the business of a producer of lithium-ion batteries or X-ray tubes that is leaving Russia. Admittedly, it doesn’t sound as modern as an innovative fintech startup, which, until recently, was some of the critical drivers of the venture capital market. Still, this path is the only one possible today.

Andrey Berezin has some important words regarding the production methods needed to excel in the venture capital market: “A lot of import substitution needs to be done and can be done, and it is being done. We’re finding some materials we used to take overseas and making domestic manufacturers work with quality. But when you make an airplane, you have such a wide range of materials and components that we can hardly replace everything in the foreseeable future. It takes decades. And a knowledge economy. There are very few countries in the world at all that make airplanes. And they certainly produce them in cooperation with the rest of the world. Now even Soviet models of airplanes cannot be resurrected because many industries necessary for aircraft manufacturing have been lost, and there are not enough professionals to do all this.”

There is already evident investment hunger for import substitution in the country. Truthfully, there are too many potential niches for the existing pool of investors: textiles, microchips, quartz tubes, tetrapak, iron components, and banal cardboard. All these groups of goods were almost entirely imported. If yesterday it was a highly competitive market with an insurmountable amount of investment for entry, today it is a vast ocean to explore for any competent investor.