What is a Forbrukslån and is it Worth Getting One?

When it comes to examining things about our adult lives and figuring out where to proceed, one of the toughest things is undoubtedly finances. Whether it is trying to purchase our first home or automobile, trying to navigate our first credit card and the payments that come with it, or dealing with student loans leftover from our youth (where applicable, of course) …well, let us just say that nothing comes easy.

Perhaps that is a part of why there is so much coverage on these topics. Honestly, it is something that I think schools do not properly prepare us for. That is why I would like to add my voice to this conversation since I think that there is a lot to cover.

Today, I want to talk about loans. I know, it might not seem like a very exciting topic to read about but trust me when I tell you that it is quite important. So, hopefully, you stick around and hear me out! Let us discuss some of the different types of loans that exist and figure out whether they might be worth it for you.

Starting off Simple: Student Loans

If you live in a country such as the United States of America or Canada, you are probably already familiar with these. There are websites like this one, https://studentaid.gov/, that can offer some valuable information about how they work. However, the federal ones are far from the only ones that most people end up having.

The fact of the matter is that many students who get their bachelor’s degree, master’s degree, or doctorate degree end up taking out at least some private student loans. These are provided by institutions that are not backed by the federal government. Often, the interest rates are much higher, meaning that it is harder to pay them off.

Unfortunately, they are the only option available for many lower-income households and students. Hopefully, in the future, something will be done to reduce the burden of student debt across the world, especially here in the United States.

Making the Most of Mortgages

Even if you have never considered purchasing a home, I am sure that you have heard this term before. Mortgages are the primary way that most people are able to buy houses these days. How do they work then, though?

Well, as for most of these types, usually the first step is finding a lender or provider. The most popular choices for mortgage lenders are typically credit unions or banks. However, there are some other options as well, including federal programs for any borrowers who are qualified.

Essentially, they are intended to provide the funding for purchasing a property other than the initial down payment that is owed. Then, the borrower makes monthly payments on that loan for many years (sometimes over thirty). If they ever default, the financial institution repossesses the property.

Despite this frightening potential, most consumers find this type of loan worth it. Of course, we can all wish to be able to spend hundreds of thousands of dollars in cash at once, but that is not possible for most people. That is what makes a mortgage so appealing.

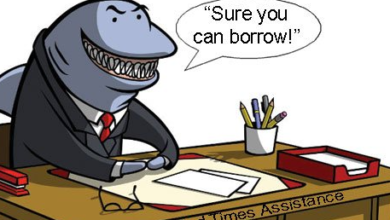

The Pickle of Payday Loans

Let us move away from some of those other types and dive into a category known as consumer loans. The first I would like to cover are payday ones, which I want to get out of the way because of the controversy surrounding them. There is a good reason that so many financial experts caution consumers against borrowing money in this fashion.

What are they, then, and how do they work? They are so appealing at first glance because they almost never have a credit requirement. Credit is sort of what rules the loan world, since your credit score will have a huge impact on the opportunities that you can qualify for.

So, this means that this type is often something that people who are struggling with building their credit gravitate towards. They are a short-term agreement. Unfortunately, the interest rates are more often not so high that the borrower will end up paying much more than the principal amount that they borrowed. That is part of what gives them their poor reputation of being predatory.

Personal Loans

I am getting a bit broader in this section, since there are a ton of different ones that can classify as a “personal” loan. This does not take away from their importance, especially in terms of our discussion today. They are often the type that people question the value of the most, besides the one I talked about right above.

There are several different ways in which you could utilize a personal loan. A popular one is to use these funds to renovate a home. I would say most of the time that this is a sound investment. Whether you are adding onto your home or simply altering a part of it for aesthetics or practical use, the human enrichment and value that you are adding tends to make it worth it in the end.

What about the more controversial ways, though? We can start with weddings. These are typically events that cost a lot of money. Why is that? Well, from the expenses of the venue to the catering to seating all of the guests…it all starts to add up, and quickly at that.

Many who decide to take out a loan utilize something known as a forbrukslån kalkulator, which is also known as a loan calculator. This can help people to understand what they might end up owing on their loans, including interest rates. It is often the interest that is the real killer, after all.

The important thing is that you do not borrow too much to pay for something that does not give any money in return, such as a wedding. There is certainly an argument to be made that the enjoyment of the event pays for itself, but speaking practically, it is generally not a great idea to borrow thirty thousand dollars for a one-day affair.

It is up to each individual to determine whether it is worth it for them, though, no matter what you are borrowing the money for. So, just bear that in mind, and do your best to keep anyone else who could be impacted by the decision appraised on the situation. Communication is key, especially when it comes to finances.

These loans are provided by financial institutions such as banks, credit unions, or online providers. Typically, the amount that they will allow you to borrow is fairly small, especially if it is an unsecured loan (meaning that the borrower does not offer up any collateral). Those are just some of the things that influence how these ones work.

Credit Card Loans

This is another type of consumer loan, and to some extent you could argue that it is still a “personal” one. However, the main difference here is that you are borrowing against the current credit limit that you have on your credit card. Since you are already approved for the card that you have, the company will not run another credit check on you.

Now, if you are wondering why that matters, it is because each time a check is run, it negatively impacts our credit score. It is only by a few points, but if you apply for many different loans or credit cards at once, it can add up to be a lot more than that. So, this type is typically seen as quite convenient.

The caveat is that the interest rates on them are often very high. This means that paying them off can be very challenging. As always, it is best to read through the terms and conditions carefully to ensure that you will not end up in insurmountable debt because of a small transaction like this.

The Final Word: are Loans Worth it?

As I have mentioned a few times, I can hardly put a blanket statement out there like “yes, they are worth it” or “no, they are not.” However, I can still offer my opinion on some of the specific types. This probably comes as no surprise to you, but payday ones are more often than not going to not be worthwhile for borrowers.

Things like mortgages or auto loans, though, usually are. Of course, there are certain situations in which they are not. However, if we are being responsible borrowers and are confident in our ability to make monthly payments on the vehicle or home that we are purchasing, these are often necessities in our every day lives. That makes them a worthwhile investment, certainly.

Personal loans are where things get a bit more complex on this front, naturally. It really does depend on what you intend to use the money for. Getting a new closet full of fancy or expensive clothing, for example, is probably not going to be something that is a good idea.

However, there are definitely situations in which borrowing money is justified. Medical emergencies in countries without free health care is an instance where this is true. The aforementioned home renovations are another one.

Credit card loans are another difficult one to pin down either way. That will be up to your own discretion at the end of the day. Just examine what the terms would be and what sort of interest rates that you would be paying, no matter which kind you are considering. You will thank yourself later.