What are the most common commercial loans?

A commercial lender will look at your debt service coverage ratio or the percentage of income that you can pay back in interest over the loan term. This ratio is calculated by dividing your net operating income by the total amount of debt service, which includes the principal balance plus interest. Lenders will also want to see documents proving your financial health, including financial statements, tax returns, and business checking account statements. Having a strong debt service coverage ratio is essential for securing a loan from a commercial lender.

Hard money loans

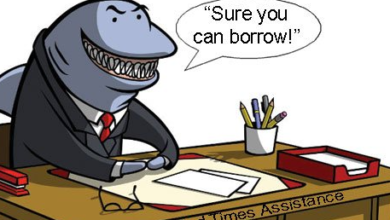

Commercial hard money loans are the most common type of loan for business owners. They are necessary for borrowers with bad credit because their credit score can affect their ability to get a bank loan. If you have a bad credit score, you may want to consider a hard money loan as it will help you avoid default. However, it is essential to remember that these loans usually have higher interest rates and fees.

Hard money loans do not have strict cash out limits and require a higher down payment than traditional loans. Suppose you have poor credit, a hard money loan from diversefunding.com.au/commercial-property-loans/ maybe your best option. Unlike traditional bank loans, hard money lenders place a greater emphasis on collateral value. Because of this, it is possible to obtain a hard money loan with thin or poor credit. Moreover, lenders who offer these loans usually don’t check borrowers’ credit or income. It means that hard money loans will be faster and more affordable.

Equipment loans

An equipment loan is a type of business loan where the equipment you plan to purchase serves as collateral for the loan. Some equipment loans offer 100% financing, while others require as little as 20 percent down.

There are several types of equipment loans, and the paperwork required for each one varies. Different lenders have different documentation requirements, so be sure to research each type of loan before applying thoroughly.

In many cases, equipment loans come with fixed interest rates. Choosing a fixed rate means that your payments will be consistent and predictable. Many equipment loans are also offered at as low as 5.5% interest rates. And if you want to finance the equipment for a longer period, you may want to consider a capital lease. These are also much cheaper than purchasing the equipment. But you must know how to choose the right type of loan for your business.

Construction loans

Although construction loans are among the most common commercial loans available, they are not available to every business. The down payment required by lenders depends on the amount of land and the project’s cost. Lenders typically require a high down payment to ensure that the funds remain in the business during construction. To secure a construction loan, you will need to provide information about your credit score and business credit history.

When selecting a construction loan, check if the lender has experience with construction projects. Inquire about their previous projects and whether or not they’ve worked with similar clients. Ask them for references, and tap your network to find a construction loan lender with good experience. You can also get recommendations from local financial institutions, banks, and community members. These sources can give you an idea of what construction loans cost in your area.

A construction loan is disbursed over time in stages, and the lender will make payments to the builder as various construction phases are complete. Depending on the construction timeline, these payments are categorized as “draws.” Construction loans have higher interest rates than traditional mortgages, but creditworthy borrowers can often qualify for favorable rates.

Bridge loans

A bridge loan can help you get the money you need to continue operating during the time between a long-term loan and a cash-flow crisis.

A typical commercial bridge loan has a term between three months and three years. This type of loan provides financing to borrowers for a period of time, usually to maximize the property and secure long-term financing. For example, a borrower might use a one-year bridge loan to bring property from 50 percent occupancy to 85% occupancy.