Learn all about signature loan.

You may be wondering… Is a signature loan the same as a cash advance? No. A signature loan is a small-dollar loan made to you by your bank or another lender. Unlike a cash advance, your signature loan is made directly to you by the lender and backed by your signature. You repay your signature loan directly to the lender with regular monthly payments. You’ll need to prove your identity (like a valid driver’s license or passport) and your income (like your paycheck or tax return), but that’s it. Your signature loan comes with no credit check, and there’s no collateral required. A signature loan requires you to apply online and get approved within minutes. After approval, the money will be deposited in your bank account as quickly as tomorrow.

What is a signature loan?

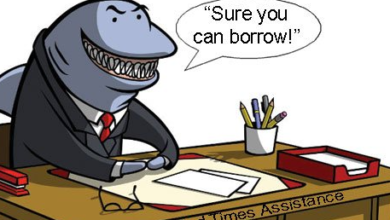

What is a signature loan? This new term refers to a unique opportunity for consumers to get the financing they need to purchase that new car, vacation, or start a business. These loans are made by private lenders willing to take on a higher risk to get the borrower a lower rate than a traditional bank could. In return, they offer additional incentives such as better terms and more flexibility than the banks typically provide. As a result, consumers can expect these loans to be tailored to fit their particular needs, ultimately making them more competitive with the banks.

When Should You Apply for a Signature Loan?

When it comes to the signature loan, you should always apply for it when ready to move forward with the sale. When I say ready, I mean that you have all the documentation in place and know what to do. So, if you need a $5,000 signature loan to close the sale, apply for it when you are ready to sell.

What Are the Benefits of a Signature Loan?

The primary purpose of a signature loan is to allow people who lack collateral to acquire cash in a relatively short period, says Paul. This is an excellent option for people who need cash for a sudden emergency or want to purchase something specific. Most lenders require customers to put down a 20% deposit, which is paid back once the total amount is borrowed.

What is The Process of Creating a Signature Loan?

Here’s how the loan process is typically handled: Once the lender has a contract for the sale of the home, the mortgage broker will set up a meeting with the buyer and seller. First, the parties will meet to determine the specifics of the loan (e.g., loan amount, terms, down payment, etc.). The lender will then provide the loan documents to the broker, who will forward the documents to the borrower for signing. When the signed documents are returned, the closing will take place.

What are The Types of Signature Loans?

A signature loan is a concise term, an unsecured personal loan that can consolidate credit card debt or purchase something like a car. However, this isn’t just a form of borrowing where you get a quick fix for a specific issue. Instead, signature loans are meant to help consumers who have accumulated debt through irresponsible spending habits and have tried to borrow money from family and friends only to fail because they could not provide secure collateral.

Conclusion

In conclusion, A signature loan is a loan offered by your bank to you that has a lower interest rate than your regular mortgage rate. With a signature loan, you don’t pay any points to the bank. Moreover, if you pay the loan back on time, you may qualify for other benefits, like having a lower APR and even being eligible for a low-interest home equity line of credit.

FAQs

1. Is there anything I need to do to qualify for a signature loan?

To qualify for a signature loan, you only need to have a steady job.

2. How do I apply for a signature loan?

You can apply for a signature loan online at www.LoanDepot.com. You can also go to your local branch of Loan Depot and ask for a signature loan.

3. What are the terms of a signature loan?

The terms of a signature loan are usually very flexible, but they will usually be paid back within 30 days and will be a fixed interest rate.

4. What happens if I default on my signature loan?

If you default on your signature loan, you will have to pay all the borrowed money.